Treasury Stock Definition, Accounting, & Acquisition Reasons

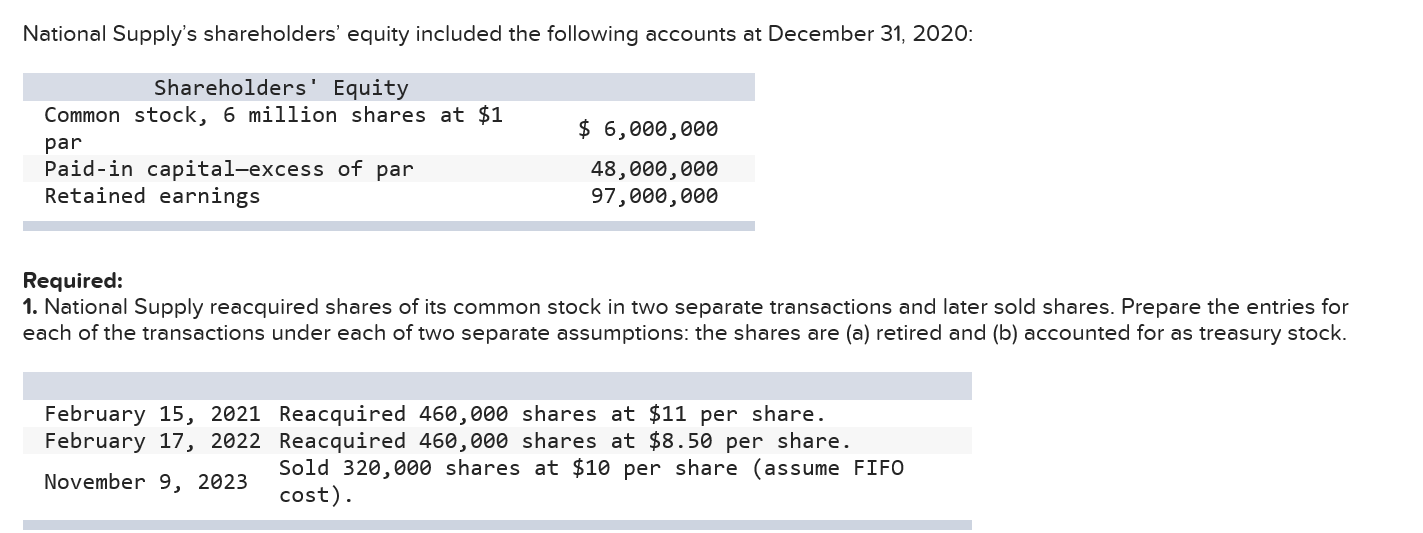

The company can either retire (cancel) the shares (however, retired shares are not listed as treasury stock on the company’s financial statements) or hold the shares for later resale. Accompanying the decrease in the number of shares outstanding is a reduction in company assets, in particular, cash assets, which are used to buy back shares. If the board elects to retire the shares, the common stock and APIC would be debited, while the treasury stock account would be credited.

Example of the Constructive Retirement Method

- This does not apply to unscheduled (special) dividends since the strike prices of options are typically adjusted to reflect the amount of the special dividend.

- In addition to approval by the company’s board of directors, there are a number of regulatory requirements a company must comply with before it can retire treasury stock.

- On the other hand, if the cost of buying treasury stock is less than the amount that the company received when it was issued, the company needs to credit the difference into the paid-in capital from the retirement of stock instead.

- Retired shares have the potential to decrease the number of outstanding shares, which in turn can help minimize dilution.

- CFDs and forex (FX) are complex instruments and come with a high risk of losing money rapidly due to leverage.

- A buyback comes with both pros and cons, and as an investor it’s important to understand why a company is buying back its shares and how that affects its value for the long-term, allowing you as an investor to make prudent investment choices.

To better understand treasury stock, it’s important to know a few related terms. When a business is first established, its charter will cite a specific number of authorized shares. After a repurchase, the journal entries are a debit to treasury stock and credit to the cash account.

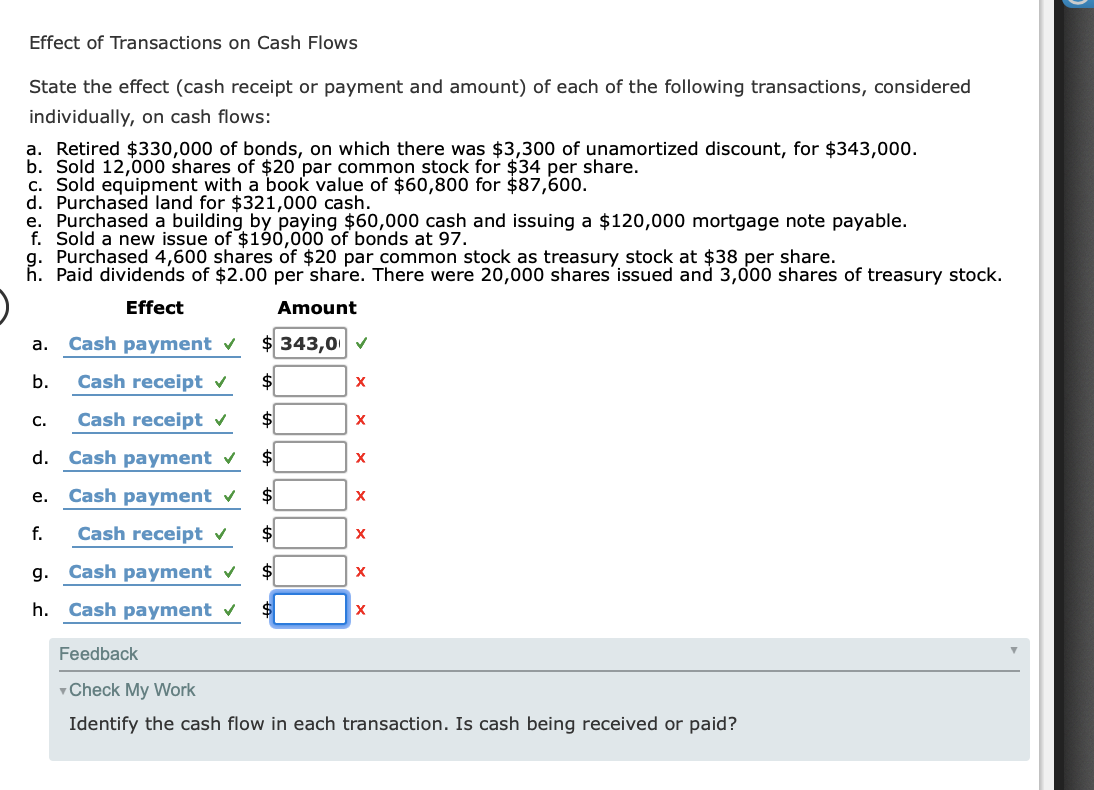

What includes in the journal entry of acquisition and retirement?

This is due to the reacquisition cost of the 100,000 shares is $200,000 more than the amount that the company ABC received when those shares were issued. For instance, the company’s earnings per share (EPS) may increase because the payments are divided among a smaller number of outstanding shares. Additionally, the reduction in the number of shares can increase existing shareholders’ ownership stake. Retired shares refer to shares of a company’s stock that have been repurchased or redeemed by the company and are no longer outstanding or held by shareholders. Nevertheless, investors may fear future shares dilution if a business has large unsold and authorized shares.

Get in Touch With a Financial Advisor

Though investors may benefit from a share price increase, adding treasury stock will—at least in the short-term—actually weaken the company’s balance sheet. The number of issued shares and outstanding shares are often one and the same. But if the company performs a buyback, the shares designated as treasury stock are issued, but no longer outstanding.

Redeemable stock (virtually always preferred shares) gives the owner the right to sell the shares to the corporation according to a prearranged schedule of prices and times. This arrangement tends to reduce the investor’s risk of a decreased market value.Some companies have issued mandatory redeemable stock, which must be turned into the company by a specific date. This arrangement essentially creates a maturity date and causes the preferred stock to act very much like a liability. Like treasury stock transactions, income or loss for the current period is not affected, nor can retained earnings be increased when capital stock is retired. Retired shares reduce the number of shares available for trading in the market, which affects the stock prices badly. Hence, it leads to the optimization of capital structure and financial stability for a company.

In the first case, when the retirement price is equal to the original issue price, the only remaining entry is a credit to Cash. Essentially, a corporation retires its stock for some of the same reasons that it purchases treasury stock. Under the cash method, the treasury account would be debited for $50,000 and cash credited for $50,000. Overall, this is a strategy companies use to manage their capital structure, signal confidence in their stock, and potentially enhance shareholder value. Suppose company Z repurchased shares at $4 per share, amounting to one lac dollars. Assume that Company A now wants to retire the 10,000 shares that were purchased.

Both treasury stocks and canceled stocks have no voting rights and cannot be paid dividends. We will discuss more on the differences and similarities between treasury shares and retired shares later. Once retired, the shares are no longer listed as treasury stock on a company’s financial statements. Non-retired treasury shares can be reissued through stock dividends, employee compensation, or capital raising. In this method, the paid-in capital account is reduced in the balance sheet when the treasury stock is bought. When the treasury stock is sold back on the open market, the paid-in capital is either debited or credited if it is sold for less or more than the initial cost respectively.

Since a buyback boosts the share price, it’s an alternative to rewarding investors with a cash dividend. Previously, buybacks offered a clear tax advantage because dividends were taxed at the higher “ordinary income” level in the U.S. But in recent years, dividends and capital gains have been taxed at the same rate, all but eliminating this benefit. A company can decide to hold onto treasury stocks indefinitely, reissue them to the public, or even cancel them. When a business buys back its own shares, these shares become “treasury stock” and are decommissioned. Of this amount, the total number of shares owned by investors, including the company’s officers and insiders (the owners of restricted stock), is known as the shares outstanding.

In the case of a stock reissue, the stock is not canceled but is sold again under the same stock number as it had previously. Or, it may give or sell the stock to its employees as some type of employee compensation february holidays 2022 or stock sale. The simplest and most widely-used method for accounting for the repurchase of stock is the cost method. Thus, one way the corporation can avoid dividend restrictions is to purchase treasury stock.